On the other hand you have absolute net leases, where the tenant is required to pay all operating expenses. On the one hand you have absolute gross leases where the owner pays all of the operating expenses related to the property. That’s why it’s critical to remember that the only way to understand a lease is to actually read it.Īt a high level leases can be viewed on a spectrum of possible structures.

Noi calculator full#

While there are many industry terms for different real estate leases, such as the modified gross lease, triple net lease, or the full service lease, it’s important to understand that these terms can have various meanings depending on who you are talking to and which part of the world you are in. As you can see from the net operating income formula above, understanding this is essential to calculating NOI. Lease analysis is the first step in analyzing any income-producing property since it identifies both the main source of income as well as who pays for which expenses.

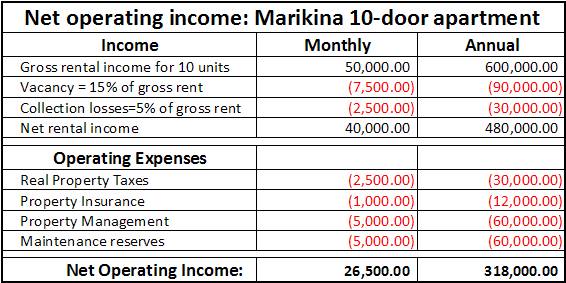

Before we go over each of the components of NOI in more detail, let’s first take a quick detour into the world of commercial real estate leases. The vast majority of commercial real estate income is generated by contractual tenant leases. In other words, the net operating income is unique to the property, rather than the investor. Unlike the cash flow before tax (CFBT) figure calculated on a real estate proforma, the net operating income figure excludes any financing or tax costs incurred by the owner/investor. Net operating income measures the ability of a property to produce an income stream from operations. Net operating income is positive when effective gross income exceeds operating expenses, and negative when operating expenses exceed effective gross income.įor the purposes of real estate analysis, NOI can either be based on historical financial statement data, or instead based on forward-looking estimates for future years, which is also known as a proforma. NOI means Net Operating Income and measures the net income generated by a property prior to taking into account any owner-specific expenses such as financing. In any case, at a high level the net operating income formula is the same and measures operating income minus operating expenses. For example, a multifamily property will have property-specific line items such as the loss to lease, while an office building will have line items for tenant reimbursements. The basic net operating income formula is as follows:ĭepending on the property type or the parties involved there is often some nuance in how the net operating income is calculated. Net operating income (NOI) is the income generated by a property minus all expenses incurred from operations. The net operating income is often referred to as “the line” because operating expenses are calculated “above the line” while capital expenditures and leasing costs are “below the line” items. Since different owners will have different capital structures and financing costs, the NOI enables evaluation of property performance prior to taking any of these owner-specific factors into account. The net operating income is useful because it describes a property’s ability to generate income without considering its capital structure. What is NOI in real estate? The net operating income is defined as the total operating income for a property minus the total operating expenses for a property. Net operating income (NOI) is the most widely used performance metric in commercial real estate. What’s Not Included in Net Operating Income.

Noi calculator how to#

Without a firm grasp of net operating income, commonly referred to as just “NOI”, it’s impossible to fully understand investment real estate transactions. Understanding Net Operating Income (NOI) is essential in commercial real estate.

0 kommentar(er)

0 kommentar(er)